Technolgy Rules

I love technology and the amazing impact it can have on someones life.

Sunday, February 13, 2056

Tuesday, September 21, 2021

PayPal launches its ‘super app’ combining payments, savings, bill pay, crypto, shopping and more

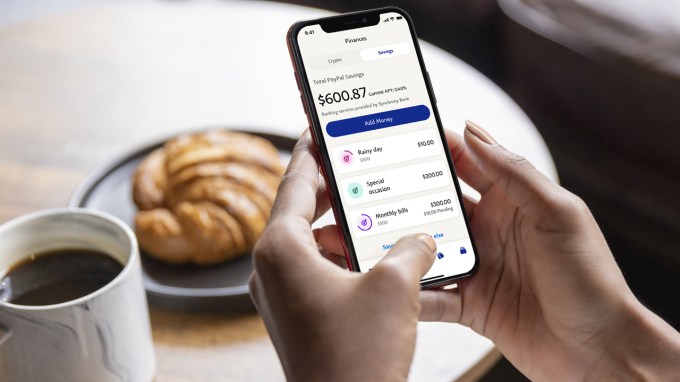

PayPal has been talking about its “super app” plans for some time, having recently told investors its upcoming digital wallet and payments app had been given a go for launch. Today, the first version of that app is officially being introduced, offering a combination of financial tools including direct deposit, bill pay, a digital wallet, peer-to-peer payments, shopping tools, crypto capabilities and more. The company is also announcing its partnership with Synchrony Bank for its new high-yield savings account, PayPal Savings.

These changes shift PayPal from being largely a payments utility that’s tacked on other offerings here and there, to being a more fully fleshed out finance app. Though PayPal itself doesn’t aim to be a “bank,” the new app offers a range of competitive features for those considering shifting their finances to neobanks, like Chime or Varo, as it will now also include support for paycheck Direct Deposits through PayPal’s bank partners, bill pay and more.

By enabling direct deposit, PayPal users can get paid up to two days earlier, which is one of the bigger draws among those considering digital banking apps over traditional banks.

In addition to shifting their paychecks to Payal, customers’ PayPal funds can then be used for things that are a part of daily life, like paying their bills, saving or shopping, for example.

The enhanced bill pay feature lets customers track, view and pay bills from thousands of companies, including utilities, TV and internet, insurance, credit cards, phone and more, PayPal says. When bill pay first arrived earlier this year, it offered access to (single-digit) thousands of billers. Now, it will support around 17,000 billers. Customers can also discover billers through an improved, intelligent search feature, set reminders to be notified of upcoming bills and schedule automatic payments for bills they have to pay on a regular basis. The bills don’t have to only be paid from funds currently in the PayPal account, but can be paid through any eligible funding source that’s already linked to their PayPal account.

Via a Synchrony Bank partnership, PayPal Savings will offer a high-yield savings account with a 0.40% Annual Percentage Yield (APY), which is more than six times the national average of 0.06%, the company says. However, that’s lower than top rivals in the digital banking market offer, like Chime (0.50%), Varo (starts at 0.20%, but users can qualify to get 3.00% APY), Marcus (0.50%), Ally (0.50%), ONE (1.00% or 3.00% on Auto-Save transactions), and others. However, the rate may appeal to those who are switching from a traditional bank, where rates tend to be lower.

PayPal believes its high-yield offering will be able to compete not based on the APY alone, but on the strength of its combined offerings.

Image Credits: PayPal

“We know that about half of customers in the United States don’t even have a savings account, much less one with a very competitive rate,” notes PayPal SVP of Consumer, Julian King. “So all in all, we think that by bringing together the full set of solutions on the platform, it’s a really competitive offering for an individual.”

The app has also been reorganized to accommodate the new features and those yet to come.

It now features a personalized dashboard offering an overview of the customer’s account. The wallet tab lets users manage Direct Deposits and connect funding sources like bank accounts and debit and credit cards alongside the ability to enroll in PayPal’s own debit, credit and cash cards. And a finance tab provides access to the high-yield savings and the previously available crypto capabilities, which allows users to buy, hold and sell Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

The payments tab, meanwhile, will hold much of PayPal’s traditional feature set, including peer-to-peer payments, international remittances, charitable and nonprofit giving, plus now bill pay and a two-way messaging feature that allows users to request payments or say thank you after receiving a payment — whether that’s between friends and family or between merchants and customers. This addition could bring PayPal more in line with PayPal-owned Venmo, which already offers the ability to add notes to payments and make comments.

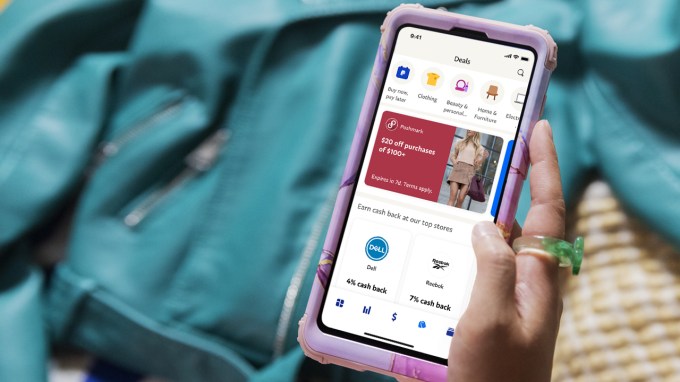

Messaging also ties into PayPal’s new Shopping hub, which is where the company is finally putting to good use its 2019 $4 billion Honey acquisition. Honey’s core features are now becoming a part of the PayPal mobile experience, including personalized deals and exclusive rewards.

Image Credits: PayPal

PayPal users will be able to browse the discounts and offers inside the app, then shop and transact through the in-app browser. The deals can be saved to the wallet for future use, so they can be applied if shopping later in the app or online. Customers will also be able to join a loyalty program, where they can earn cashback and PayPal shopping credit on their purchases. The company says these personalized deals will improve over time.

“We’ll use AI and [machine learning] capabilities to understand what kind of shopping deals are most interesting to customers and continue to develop that over time. They’ll just get smarter and smarter as the product gets more usage,” notes King. This will include using the data about the deals a customer likes, then bringing similar deals to them in the future.

Also new in the updated mobile app is the addition of PayPal’s crowdsourced fundraising platform, the Generosity Network, first launched late last year. The network is PayPal’s answer to GoFundMe or Facebook Fundraisers, by offering tools that allow individuals to raise money for themselves, others in need, or organizations like small businesses or charities. The network is also now expanding to international markets with Germany and the U.K. to start, with more countries to come.

As PayPal has said, the new app is laying the groundwork for other new products in the quarters to come. The biggest initiative on its roadmap is a plan to enter the investment space, to rival other mobile investing apps, like Robinhood. When this arrives, it will support the ability to buy stocks, fractional stocks and ETFs, PayPal says.

It will also later add support for paying with QR codes, like Venmo, and tools for using PayPal to save while in stores.

The updated app is rolling out starting today in the U.S. as a staggered release that will complete in the weeks ahead. However, PayPal Savings won’t be available immediately — it will arrive in the U.S. in the “coming months,” as will some of the shopping and rewards tools.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/21/paypal-launches-its-super-app-combining-payments-savings-bill-pay-crypto-shopping-and-more/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662948151644356608

via http://www.gadgetscompared.com

Netflix launches free plan in Kenya to boost growth

Netflix said on Monday it is launching a free mobile plan in Kenya as the global streaming giant looks to tap the East African nation that is home to over 20 million internet users.

The free plan, which will be rolled out to all users in Kenya in the coming weeks, won’t require them to provide any payment information during the sign-up, the company said. The new plan is available to any user aged 18 or above with an Android phone, the company said. It will also not include ads.

Netflix, available in over 190 countries, has experimented with a range of plans in recent years to lure customers in developing markets. For instance, it began testing a $3 mobile-only plan in India in 2018 — before expanding it to users in several other countries.

This is also not the first time Netflix is offering its service for free — or at little to no price. The company has previously supported free trials in many markets, offered a tiny portion of its original movies and shows to non-subscribers, and has run at least one campaign in India when the service was available at no charge over the course of a weekend.

But its latest offering in Kenya is still remarkable. The company told Reuters that it is making about one quarter of its movies and television shows catalog available to users in the free plan in the East African nation.

“If you’ve never watched Netflix before — and many people in Kenya haven’t — this is a great way to experience our service,” Cathy Conk, Director of Product Innovation at Netflix, wrote in a blog post.

“And if you like what you see, it’s easy to upgrade to one of our paid plans so you can enjoy our full catalog on your TV or laptop as well.”

The company didn’t disclose how long it plans to offer this free tier in Kenya — and whether it is considering expanding this offering to other markets.

On its past earnings calls, Netflix executives have insisted that they study each market and explore ways to make their service more compelling to all. The ability to sign up without a payment information lends credibility to such claims. Many individuals in developed countries don’t have a credit or debit card, which renders services requiring such payment instruments at the sign-up inaccessible to them.

The new push to win customers comes as the company, which is also planning to add mobile games to its offering, added only 1.5 million net paying subscribers in the quarter that ended in June this year, lower than what it had forecast. Netflix, which has amassed over 209 million subscribers, as well as Amazon Prime Video and other streaming services are increasingly trying to win customers outside of the U.S. to maintain faster growth rates.

Earlier this year, Amazon introduced a free and ad-supported video streaming service within its shopping app in India to tap more customers.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/20/netflix-free-plan-kenya/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662921730026766336

via http://www.gadgetscompared.com

Monday, September 20, 2021

iOS 15 adds all the little features that were missing

The release of iOS 15 should be a major event for mobile operating systems. And yet, this year, there’s no breakthrough feature or overarching theme that makes this release stand out. Apple has focused on quality-of-life updates as well as new features for its own apps.

The result is a solid update that is not going to be controversial. Some people are going to take advantage of the new Focus feature. They’ll spend a lot of time customizing their phone to make it as personal as possible. Other people are just going to miss or dismiss the new features.

This year’s update is also a bit different because you don’t have to update to iOS 15. If you’re fine with iOS 14, Apple won’t force you to make the jump to iOS 15. You’ll still receive security patches. Some people will simply dismiss iOS 15 altogether.

It seems like a small change but it actually says a lot about the current state of iOS. Apple considers iOS as a mature platform. Just like you don’t have to update your Mac to the latest version of macOS if you don’t want to, you can now update at your own pace.

iOS should also be considered as a mature platform for app developers. iOS 15 adoption will be slower than usual as people won’t necessarily update to iOS 15 right away. Apps should potentially work on older iOS versions for longer.

Of course, users will ‘update’ to a new version of iOS when they buy a new iPhone and replace their old iPhone. But Apple has And people who pre-ordered the iPhone 13 will get iOS 15.

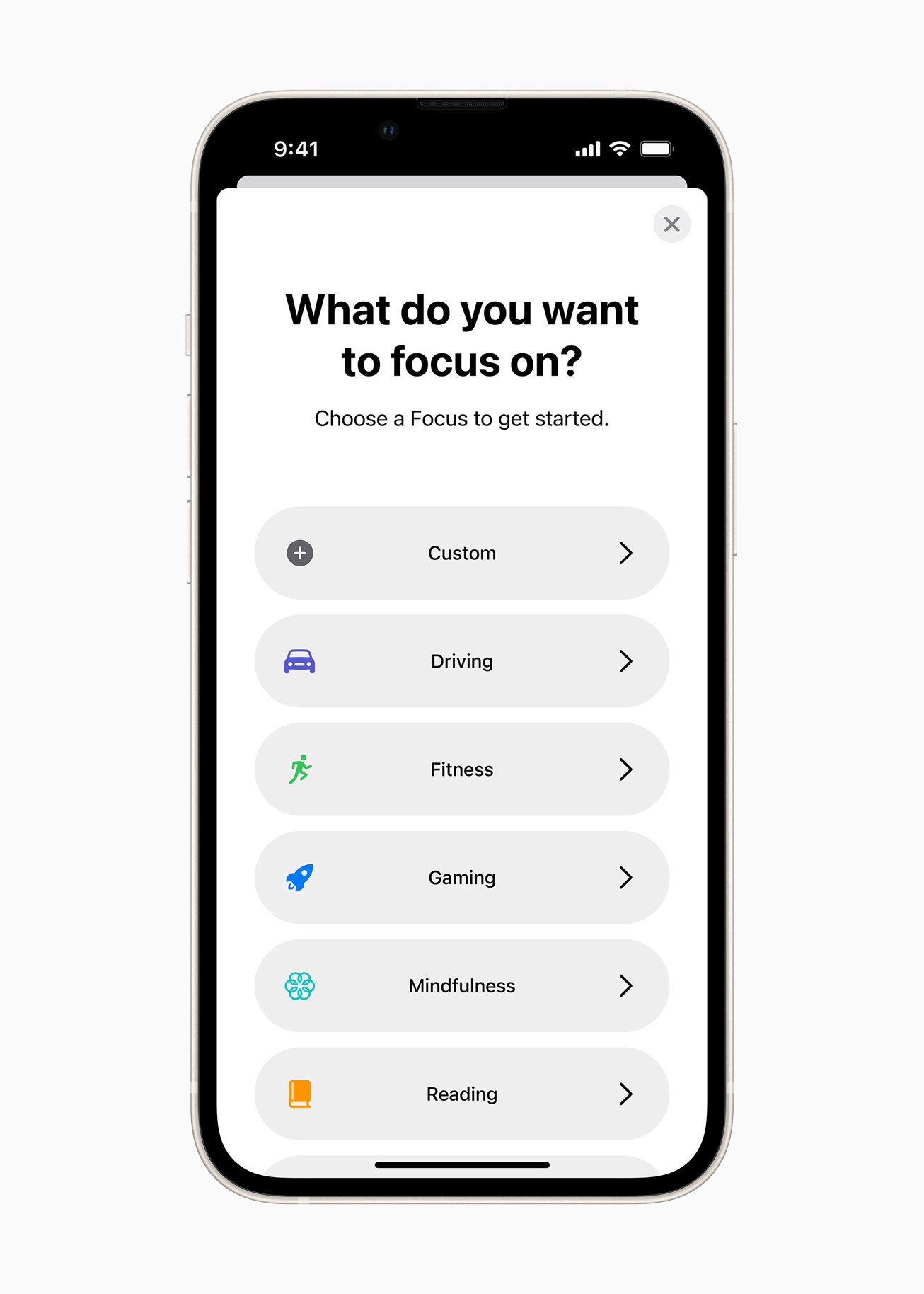

Image Credits: Apple

Focusing on you instead of your phone

One of the biggest change in iOS 15 is the ability to change your Focus from Control Center. It’s a surprisingly powerful feature with a lot of options and tweaks. I would say it doesn’t feel like an Apple feature.

But it’s definitely one of the most interesting features of iOS 15. Chances are you spend a lot of time with your phone and your device requires a lot of attention from you. With this new feature, it reverses the balance and puts you back in charge.

‘Do Not Disturb’ users are already quite familiar with the idea that you can silence notifications when you don’t want them. If you want to keep using ‘moon mode’ with iOS 15, you don’t have to change anything.

But you can now create additional Focuses. By default, Apple suggests a few Focuses — Work, Sleep, Driving, Fitness, Gaming, Mindfulness, Personal and Reading. Each Focus is customizable to your needs and you can create new Focuses from scratch.

When you turn on a specific Focus, it basically blocks notifications by default. You can then add people and apps so that notifications from those people and apps still go through. App developers can also mark a notification as time sensitive so that it always goes through. I hope they won’t abuse that feature.

There are three more settings that you can activate. First, you can optionally share that your notifications are currently silenced in Messages and compatible third-party apps. Second, you can hide home screen pages altogether. Third, you can hide notifications from the lock screen and hide badges from the home screen.

Focus gets particularly interesting when you realize that you can couple specific Focuses with automation features. For instance, you can automatically turn on ‘Sleep’ at night or you can automatically turn on ‘Work’ when you arrive at work.

Power users will also have a lot of fun setting up a Focus and pairing it with a Shortcut. For instance, you could use Shortcuts to open the Clock app when you turn on Sleep mode. You get it, this new feature has a lot of depth and beta users have just started scratching the surface.

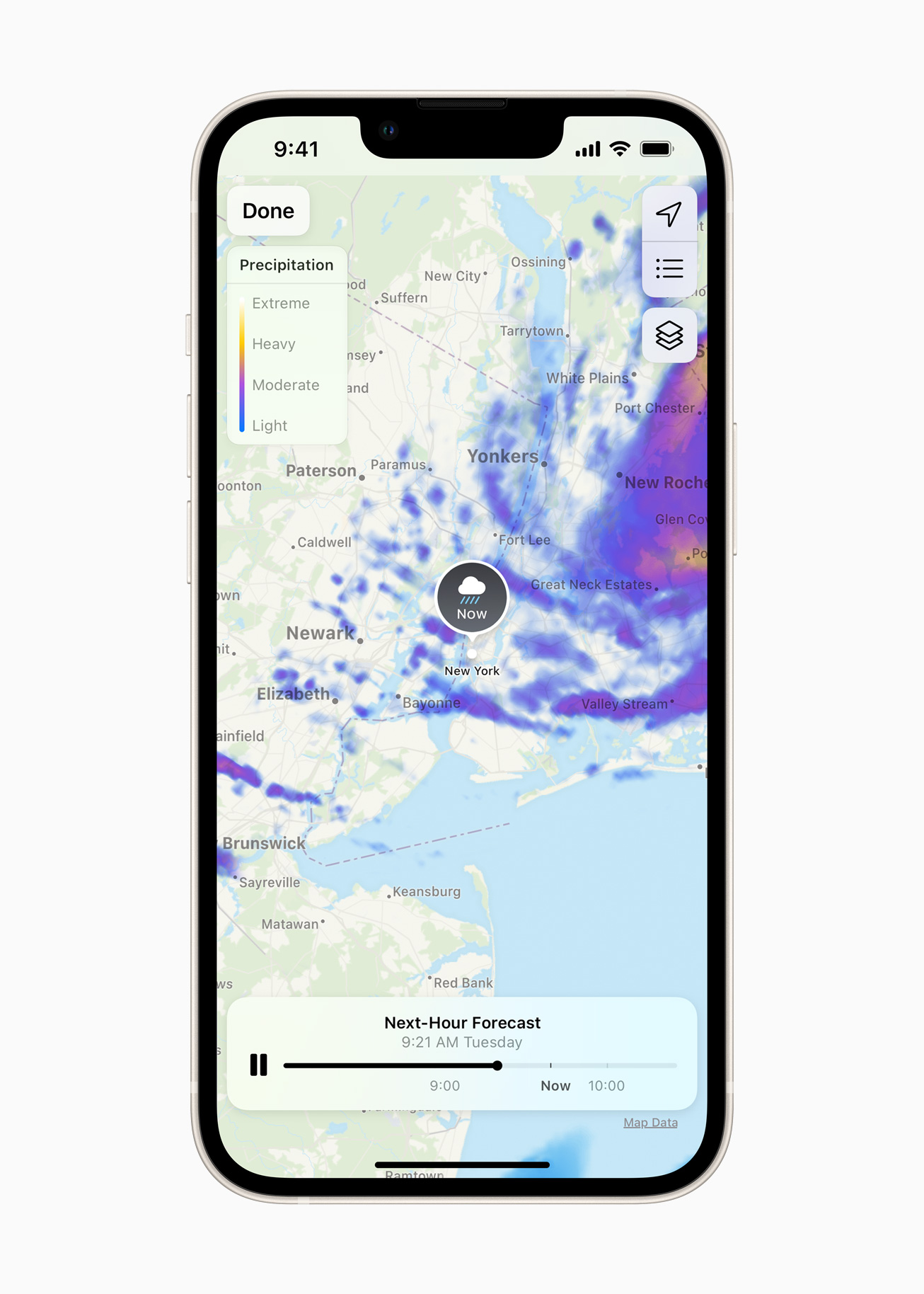

Image Credits: Apple

Update all apps

With iOS 15, Apple has improved nearly all the default apps. Some additions are definitely nice improvements. Others have been a bit more controversial.

Let’s start with the controversial one, Safari’s design has been updated. But what you saw at WWDC in June doesn’t look at all like what’s shipping today. Essentially, Apple has listened to feedback and changed the user interface of its web browser during the summer.

By default, the address bar is now at the bottom of the screen, right above the row of buttons that let you open bookmarks, share the current page or go to the previous page. I think it works better. But if you really don’t want the address bar at the bottom, you can move it back to the top of the screen.

Other than that, Safari changes are all good improvements. For instance, the browser now supports traditional web extensions. It’s going to be interesting to see if popular Google Chrome extensions eventually come to Safari. Another nice new feature is the ability to create tab groups and find your tab groups from your other devices.

FaceTime has become a versatile video-conferencing service. You can now create links, share them with friends and add them to calendar invites. For the first time, people who don’t own an Apple device will be able to join FaceTime calls from a web browser. There’s also a new Zoom view… I mean, grid view.

Unfortunately, the big new FaceTime feature is not ready for prime time just yet. SharePlay, the feature that lets you sync audio and video playback with your friends, is going to be released later this Fall.

The Weather app has also been redesigned. It is now packed with a lot more information, such as precipitation maps, next-hour precipitation notifications and a new UV index. It has become a solid alternative to third-party weather apps. I still use Snowflake but differences are smaller and smaller.

Messages is now better integrated with other Apple apps. Whenever someone sends you an article, a photo album, a podcast or a song, you’ll see those recommendations in Apple’s other apps — Apple News, Photos, Apple Podcasts, Apple Music, etc. Once again, this is a nice addition in my testings but it’s not going to change the way you use your phone.

Apple Maps is getting better and better, especially if you live in San Francisco. If you haven’t used it in a few years, I encourage you to try it again. It’s now a solid alternative to Google Maps.

Some cities, such as San Francisco, Los Angeles, New York and London, are receiving new detailed maps with 3D buildings, bus lanes, sidewalks and more. It feels like navigating a video game given how detailed it is. The app has also been redesigned with new place cards, a new driving user interface and settings in the app.

Photos is also receiving a bunch of improvements. Every year, the company is refining Memories. I’m not sure a ton of people are using this feature, but it’s better than before. There are now more information if you swipe on a photo as well, such as the shutter speed and lens that were used.

But the biggest change to your photo library is that you can now search for text in your photo. iOS is scanning your photos to find text and save it for Spotlight searches.

Similarly, you can now point your camera at text and select text from there. It is incredibly convenient if you’re looking for the restaurant address on the menu and want to share it with a friend or if you’re traveling and you want to translate some text.

Image Credits: Apple

Tips and tricks

There are a ton of small changes that make iOS 15 better than iOS 14. Let me list some of them:

- If you have a compatible home key, hotel key, office key or ID card, you can now add all of those to the Wallet app.

- You can share some health data with someone else. It can be useful if you’re living far away from your loved ones or if you want to update your healthcare team.

- If you pay for iCloud, you’re now an iCloud+ users. In addition to storage, you get additional features. iCloud Private Relay, which is available as a beta feature, lets you browse the web with increased privacy. Hide My Email lets you create randomly generated email addresses to create new accounts around the web.

- Similarly, if your family is using iCloud for their email addresses, you can now set up a personal domain name and set it up in iCloud.

- iOS uses on-device speech recognition, which means that you can dictate text much faster.

- But that’s not all, iOS processes some Siri requests on your device directly, which means that you can start a timer, set an alarm or change the music instantly. It has changed the way I use Siri.

- You can add an account recovery contact in case you get locked out of your iCloud account. This is important to convince more people to use two-factor authentication.

- Talking about two-factor authentication, Apple’s built-in password manager called ‘Passwords’ can now save 2FA details and auto-fill 2FA fields. It works pretty much like 2FA in 1Password.

- You can set up a legacy person for your Apple ID. I encourage you to look at that feature carefully. I’ve talked with several persons who couldn’t get their loved one’s photos after they passed away because Apple couldn’t just hand out the photos.

- Apple has added tags to Reminders and Notes. You can also @-mention people in Notes.

As you can see, the list of changes in iOS 15 is quite long. But it’s up to you to decide whether you want to update to iOS 15. When Apple added cut, copy and paste with iPhone OS 3, it was an obvious decision. I personally like the new features and it was worth updating. And I hope this review can help you decide whether to update or not.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/20/ios-15-adds-all-the-little-features-that-were-missing/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662883988621475840

via http://www.gadgetscompared.com

iOS 15 is now available to download

Apple has just released the final version of iOS 15, the next major version of the operating system for the iPhone. It is a free download and it works with the iPhone 6s or later, both generations of iPhone SE and the most recent iPod touch model (iPad users will also be able to update to iPadOS 15 and watchOS 8 today).

The biggest change of iOS 15 is a new Focus mode. In addition to “Do not disturb,” you can configure various modes — you can choose apps and people you want notifications from and change your focus depending on what you’re doing. For instance, you can create a Work mode, a Sleep mode, a Workout mode, etc.

There are many new features across the board, such as a new Weather app, updated maps in Apple Maps, an improved version of FaceTime, and more. Safari also has a brand-new look.

The new version of iOS also scans your photos for text. Called Live Text, this feature lets you highlight, copy and paste text in photos. It could be a nice accessibility feature as well; iOS is going to leverage that info for Spotlight. You can search for text in your photos directly in Spotlight and it’ll pull out relevant photos. These features are handled on-device directly.

Paid iCloud users have been upgraded to iCloud+. In addition to more storage, iCloud+ subscribers get a handful of new features. iCloud Private Relay, which is available as a beta feature, lets you browse the web with increased privacy. Hide My Email lets you create randomly generated email addresses to create new accounts around the web. ICloud email users can also switch to a personal domain name.

The update is currently rolling out and is available both over-the-air in the Settings app, and by plugging your device to your computer for a wired update. But first, back up your device. Make sure your iCloud backup is up to date by opening the Settings app on your iPhone or iPad and tapping on your account information at the top and then on your device name. Additionally, you can also plug your iOS device to your computer to do a manual backup in Finder or iTunes for Windows (or do both, really).

Don’t forget to encrypt your backup in iTunes. It is much safer if somebody hacks your computer. And encrypted backups include saved passwords and health data. This way, you don’t have to reconnect to all your online accounts.

Once this is done, you should go to the Settings app, then “General” and then “Software Update.” You should see “Update Requested…” It will then automatically start downloading once the download is available.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/20/ios-15-is-now-available-to-download/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662883987778404353

via http://www.gadgetscompared.com

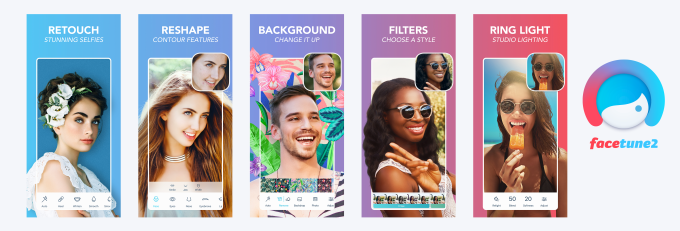

Facetune maker Lightricks raises $130 million ahead of M&A plans

Facetune developer Lightricks, which operates over a dozen subscription-based photo and video editing apps across iOS and Android, now has $130 million in new funding to further grow its business. The company’s newly announced Series D round includes $100 million in primary and $30 million in secondary funding, and now values the company at $1.8 billion. To date, Lightricks has raised $335 million.

The new round was co-led by New York-based VC firm Insight Partners and Hanaco Venture Capital and includes new investors Migdal Insurance, Altshuler Shaham, and Shavit Capital. Existing investors Goldman Sachs Asset Management, Clal Tech, Harel Insurance and Finance, and Greycroft, also participated.

The company’s last round of funding was its pre-pandemic raise of $135 million, which minted the company as a unicorn.

Based in Jerusalem, Lightricks has been best known for its photo-editing app Facetune, which puts Photoshop-like retouching tools into the hands of consumers. The app quickly gained traction as online influencers tweaked their Instagram photos to look more polished, perfected, and blemish-free. This growth wasn’t without controversy, however, as some argued how image editing apps like Facetune took airbrushing too far, contributing to body image issues that now, Facebook’s internal research indicates, could have a negative effect on teenagers’ mental health.

But Facetune was only the beginning for what’s since become a mobile editing empire for Lightricks, at a time when everyone is trying to look their best online and create compelling content. Over the years, the company has rolled out the more powerful Facetune 2, along with other creativity and mobile photo apps that weren’t focused on selfies. It also expanded its product lineup beyond the creator crowd to bring a suite of tools to online marketers and small businesses. And last year, Lightricks more directly responded to the growth in online video as a form of self-expression with a new selfie retouching tool called Facetune Video — essentially the Facetune for the TikTok era.

Image Credits: Lightricks

The company benefitted from Covid-19 lockdowns, as well, as more people participated online and creators, as a group, became more well-established as a way for brands to reach consumers. During peak lockdowns, the company saw a 90% increase in usage across its apps in the U.S. Meanwhile, downloads for its popular Videoleap video editing apps jumped 70% since the start of the pandemic, as TikTok adoption also grew.

Across its suite of apps, the company now touts 29 million monthly active users, where over 5 million are paid subscribers. Its users average around 78 million monthly exports, indicating Lightricks’ sizable impact on the creator economy. In 2021, Lightricks is on track for over $200 million in revenue and plans to grow that figure by 40% in the year ahead.

To do so, the company’s strategy will change. Instead of just developing its own apps, it’s now on the hunt for potential acquisitions.

“Our plan is to grow into a one-stop-shop creator platform, supporting creators throughout their journey, from content creation to monetization,” says Zeev Farbman, CEO and Co-Founder of Lightricks. “To do so, we are broadening our acquisition activity, while developing other services in-house—our overall M&A objective is advancing our shift into the creator’s platform. To begin, we are planning between three to five acquisitions, each with a budget of tens of millions of dollars. However, we are also on the lookout for larger ticket size deals if there is enough conviction on both sides,” he notes.

Image Credits: Lightricks

The company will also enhance its own technology to develop tools and services that will help all creators with content production and monetization, and it will grow its team.

Currently, Lightricks has 460 employees and plans to add 60 more by the end of 2021. The longer-term goal is to grow the team to 1,000 employees by the end of 2023, across roles that include developers, designers, and marketing. While most of this growth to date has taken place in Jerusalem, over the next two years, the company plans to grow its teams locally in Haifa, as well as internationally in London and Shenzhen. It may add on other locations through M&As, as well.

The U.K. office is now the largest outside of Lightricks’ headquarters, with 23 people. This number is expected to climb to 35 by year-end and be closer to 50 or 60 by the end of 2022, with growth focused on the production of the company’s new photography app plus Customer Experience and Marketing teams, which were previously only in Israel.

In the U.S., Lightricks is focused on content.

“Our U.S.-based activity will focus mostly on our content efforts that will provide a vast array of original, acquired, and co-produced content to inspire, educate and entertain creators across the entirety of their careers,” notes Farbman. “This includes written, video, audio, short and long-form, fun and informative content,” he says.

Investors say they see the potential for Lightricks to continue to grow as the creator economy booms.

“The creator economy has changed the way we, as a society, experience social networks,” said Pasha Romanovski, Co-Founding Partner of Hanaco Ventures, in a statement. “Audiences constantly consume information through the different content channels daily. Lightricks’ platform enables creators to have a broader, more professional, and higher-quality set of tools to optimize content. At a time when we are seeing content creators monetize content on social media at new levels, it is clear that Lightricks’ platform has the ability to create a one-stop shop that will be meaningful to its users,” he added.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/20/facetune-maker-lightricks-raises-130-million-ahead-of-ma-plans/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662865112554782720

via http://www.gadgetscompared.com

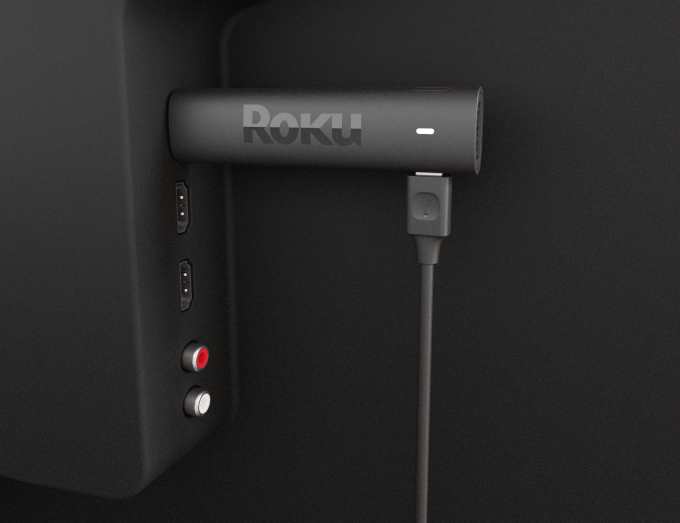

Roku debuts new Streaming Stick 4K bundles, software update with voice and mobile features

Weeks after Amazon introduced an updated Fire TV lineup that included, for the first time, its own TVs, Roku today is announcing its own competitive products in a race to capture consumers’ attention before the holiday shopping season. Its updates include a new Roku Streaming Stick 4K and Roku Streaming Stick 4K+ — the latter which ships with Roku’s newer hands-free voice remote. The company is also refreshing the Roku Ultra LT, a Walmart-exclusive version of its high-end player. And it announced the latest software update, Roku OS 10.5, which adds updated voice features, a new Live TV channel for home screens, and other minor changes.

The new Streaming Stick 4K builds on Roku’s four-year-old product, the Streaming Stick+, as it offers the same type of stick form factor designed to be hidden behind the TV set. This version, however, has a faster processor which allows the device to boot up to 30% faster and load channels more quickly, Roku claims. The Wi-Fi is also improved, offering faster speeds and smart algorithms that help make sure users get on the right band for the best performance in their homes where network congestion is an increasingly common problem — especially with the pandemic-induced remote work lifestyle. The new Stick adds support for Dolby Vision and HDR 10+, giving it the “4K” moniker.

This version ships with Roku’s standard voice remote for the same price of $49.99. For comparison, Amazon’s new Fire TV Stick Max with a faster processor and speedier Wi-Fi is $54.99. However, Amazon is touting the addition of Wi-Fi 6 and support for its game streaming service, Luna, as reasons to upgrade.

Roku’s new Streaming Stick 4K+ adds the Roku Voice Remote Pro to the bundle instead. This is Roku’s new remote, launched in the spring, that offers rechargeability, a lost remote finder, and hands-free voice support via its mid-field microphone, so you can just say things like “hey Roku, turn on the TV,” or “launch Netflix,” instead of pressing buttons. Bought separately, this remote is $29.99. The bundle sells for $69.99, which translates to a $10 discount over buying the stick and remote by themselves.

Image Credits: Roku

Both versions of the Streaming Stick will be sold online and in stores starting in October.

The Roku Ultra LT ($79.99), built for Walmart exclusively, has also been refreshed with a faster processor, more storage, a new Wi-Fi radio with up to 50% longer range, support for Dolby Vision, Bluetooth audio streaming, and a built-in ethernet port.

Plus, Roku notes that TCL will become the first device partner to use the reference designs it introduced at CES for wireless soundbars, with its upcoming Roku TV wireless soundbar. This device connects over Wi-Fi to the TV and works with the Roku remote, and will arrive at major retailers in October where it will sell for $179.99.

The other big news is Roku’s OS 10.5 software release. The update isn’t making any dramatic changes this time around, but is instead focused largely on voice and mobile improvements.

The most noticeable consumer-facing change is the ability to add a new Live TV channel to your home screen which lets you more easily launch The Roku Channel’s 200+ free live TV channels, instead of having to first visit Roku’s free streaming hub directly, then navigate to the Live TV section. This could make the Roku feel more like traditional TV for cord-cutters abandoning their TV guide for the first time.

Other tweaks include expanded support for launching channels using voice commands, with most now supported; new voice search and podcast playback with a more visual “music and podcast” row and Spotify as a launch partner; the ability to control sound settings in the mobile app; an added Voice Help guide in settings; and additional sound configuration options for Roku speakers and soundbars (e.g. using the speaker pairs and soundbar in a left/center/right) or in full 5.1 surround sound system).

A handy feature for entering in email and passwords in set-up screens using voice commands is new, too. Roku says it sends the voice data off-device to its speech-to-text partner, and the audio is anonymized. Roku doesn’t get the password or store it, as it goes directly to the channel partner. While there are always privacy concerns with voice data, the addition is a big perk from an accessibility standpoint.

Image Credits: Roku

One of the more under-the-radar, but potentially useful changes coming in OS 10.5 is an advanced A/V sync feature that lets you use the smartphone camera to help Roku make further refinements to the audio delay when using wireless headphones to listen to the TV. This feature is offered through the mobile app.

The Roku mobile app in the U.S. is also gaining another feature with the OS 10.5 update with the addition of a new Home tab for browsing collections of movies and shows across genres, and a “Save List, which functions as a way to bookmark shows or movies you might hear about — like when chatting with friends — and want to remember to watch later when you’re back home in front of the TV.

The software update will roll out to Roku devices over the weeks ahead. It typically comes to Roku players first, then rolls out to TVs.

from RSSMix.com Mix ID 8176981 https://techcrunch.com/2021/09/20/roku-debuts-new-streaming-stick-4k-bundles-software-update-with-voice-and-mobile-features/

http://www.gadgetscompared.com

from Tumblr https://ikonografico.tumblr.com/post/662865111413850112

via http://www.gadgetscompared.com